Investments

Hetica Chain Fund: investing via the Blockchain

Exposure to the world of Blockchain

Hetica Capital has set up service companies specialising in Security Token Offerings (STOs), and holds a stake in the only regulated secondary market for exchanging these tokens, the Swiss platform European Digital Assets Exchange (EDSX).

Investment philosophy

The Fund acquires security tokens at issue and trades them on dedicated trading platforms, primarily the European Digital Asset Platform (EDSX).

The tokens are digitised securities that can represent shares in share capital, bonds or shares in the results of a specific corporate investment project.

What are tokens?

We can say that tokens are the digital version of shares and bonds, since, like bonds, they give the holder the right to participate in company results or receive future coupon streams.

However, they differ in a number of ways, including the fact that they are traded on a blockchain, a distributed digital ledger that ensures their security and identifiability at all times.

Token platforms are a modern, more efficient and structured version of crowdfunding platforms. Compared to crowdfunding experiences, the use of tokens allows the subscriber to demobilise his investment within a secondary market, selling his participation to third parties in a secure and cost-free manner.

The growth of crowdfunding

In recent years, crowdfunding platforms have grown exponentially, allowing businesses of all sizes, especially new project startups, to raise the capital they need to launch new projects.

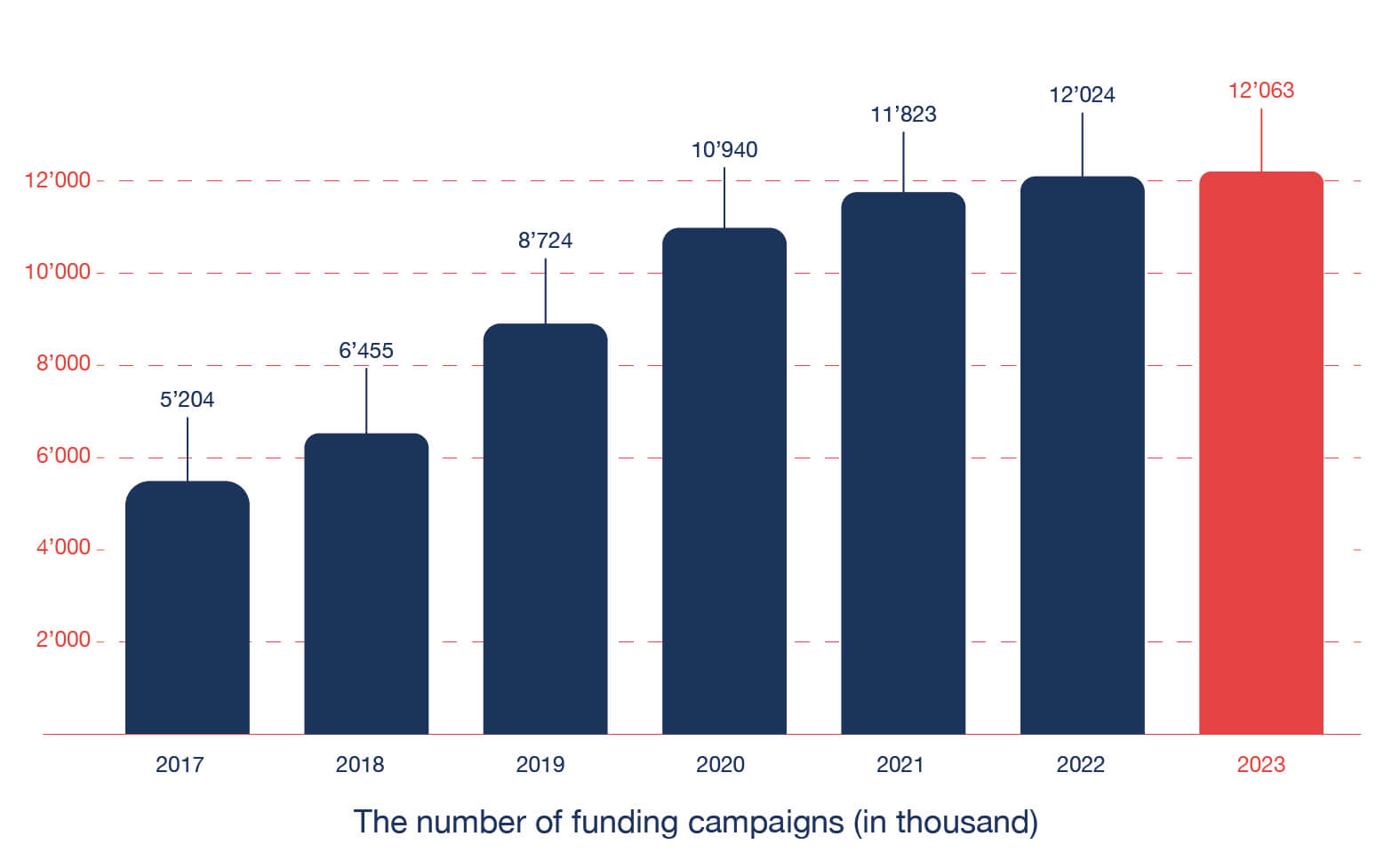

Since 2017, globally, the number of crowdfunding campaigns has grown from over 5 million to almost 12 million initiatives.

Expectations are for robust growth in the coming years as well, which we believe will greatly benefit from the use of tokens and their inclusion in exchange marketplaces such as, for example, the EDSX platform.

The investment target

The Fund will select tokens listed on official buying and trading platforms, such as EDSX, on the basis of certain selection criteria, among which we highlight:

- The innovativeness of the business formula;

- The presence of certifications or 'awards' as synonyms for excellence;

- Strong corporate leadership;

- The commitment of capital by the founders.

In terms of preferred sectors, the Fund will focus on the following:

- Internet applications and 'internet of things';

- Business related to ecological transition;

- Personal protective equipment;

- Robotics and biotechnology.

How to subscribe to the Fund

Hetica Chain is a closed-end investment fund under Luxembourg law that invests in tokens both when issued and traded on the secondary market. The fund has a duration of 4 years and can be subscribed by qualified and professional investors through banking channels.

- Denomination: Hetica Chain Fund Slp

- ISIN: LU2280237368

- Type: closed fund

- Constitution: February 2021

- Bank : OLKYPAY S.A.

- Manager: Quality Investment Asset Management

- Advisor: Hetica Capital

- Target: qualified and professional investors

- Duration: 4 years

- NAV: calculated semi-annually

(for other information see the Prospectus)

The Fund may be subscribed through a single share class:

- CLASS «A»

portion of the fund dedicated to investments over €125,000.

The termsheet shows entry, management and performance fees which differ according to the share classes mentioned.

I documenti che formano il pacchetto di sottoscrizione del fondo sono i seguenti:

- Prospetto informativo

- Termsheet

- Modulo di sottoscrizione