During 2020 the Federal Reserve nearly doubled its assets by expanding its balance sheet by over $3 trillion, which is unprecedented to say the least. This was accompanied by fiscal stimulus, albeit to a lesser extent than what the new US President is going to do.

We know that the monetary expansion of a central bank does not always translate into an increase in liquidity in the real economy, since part of this liquidity remains "imprisoned" in the interbank system.

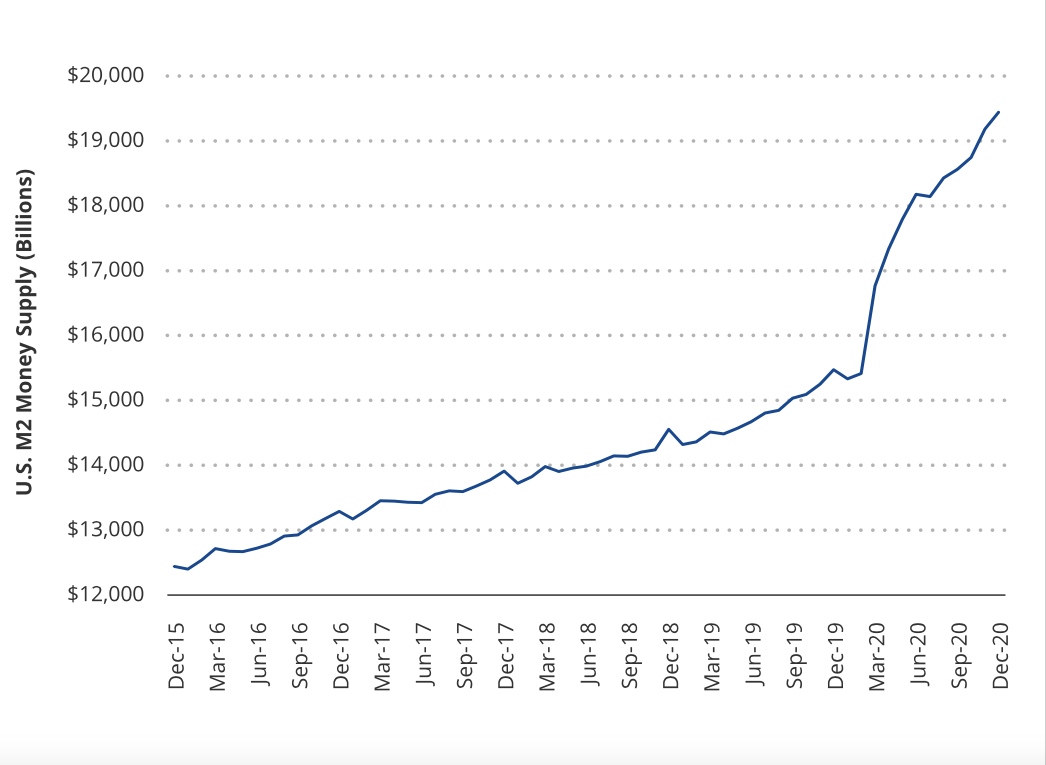

To assess the impact of monetary expansion on the real economy we need to look at M2, the money supply aggregate that includes both cash and checking and savings accounts. The M2 aggregate in the US rose by 25% during 2020, as shown in the chart below, which confirms that the Fed's action also targeted households and businesses, not just banks (see accompanying chart).

This massive build-up of liquidity in the market leads traders to raise inflation expectations, and consequently to reposition their portfolios to assets protected from relative risk.

Important evidence of this is provided by the considerable appreciation of Treasury Inflation-Protected Securities(TIPS), the US inflation-indexed bonds, which rose 9.5% during 2020.

Buying TIPS is a kind of insurance against inflation, but investors can do much more to protect their assets against this type of risk: they can invest in real, i.e. non-financial, assets. In fact, they are already doing so.

Here, too, empirical evidence helps. In December 2020 alone, the largest increases in invested assets were experienced by real estate funds (+8.6%), agribusiness-related stocks (+3%), clean energy stocks (+1.8%), and gold (+0.7%).

It should be noted that all these asset classes have in common that they do not produce formal financial returns (i.e. coupons), therefore their attractiveness increases also as a function of the decrease in interest rates on bonds, which takes away the advantage, compared to bricks and mortar, of paying coupons.

The definition of "real" assets is under review. In the past, substantially tangible assets were considered real, primarily bricks and mortar, and by association gold bars and primary commodities (grain, iron etc).

Today, this definition certainly needs to be revised. We can consider as "real" all assets whose value is weakly correlated with typical stock market and monetary cycles and which, because of this, maintain or increase their value at the same rate of inflation. Thus, if inflation rises these assets increase in value in a way that protects the purchasing power of the holders.

To the classic real estate sector, precious metals and "primary" commodities we can certainly add works of art and other luxury goods with similar characteristics of scarcity and ability to act as a "store of value", within which we believe that a considerable space will be covered by vintage vehicles (cars, motorcycles, planes and boats).

That said, we believe that the desirability of real assets during 2021 (but also afterwards) can only increase. Both because rising inflation expectations will require their use and because central banks will need to keep real (i.e. inflation-adjusted) interest rates below zero to make the growing public debts of state treasuries bearable. But in doing so, they will be blowing the sails of real assets.

Hetica Capital Research Centre